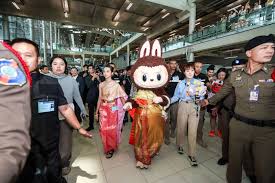

Firms have long leveraged the power of celebrity influence to promulgate global image and advertising. Few crazes, however, have matched that of Labubu, a small cosmetic doll that has seen its popularity flourish over the last year. Following K-pop star Lisa’s repeated flaunting of the bunny-eared characters since April 2024 – from the tiny charms paired with her OOTD to unboxing videos – the globe went crazy over blind box these Labubus, a massive boost to their creator, PopMart.

Figure 1: BLACKPINK Star Lisa

Initially founded in 2010 by Wang Ning, Pop Mart’s decades of groundwork designing IP and characters pivoted in 2016, popularising trends of blind box collectables, primarily in the domestic Chinese market. By systematising and revolutionising the classic gashapon thrill, where the purchase of every blind box becomes a gamble to reveal the set of designs with one rarer secret chase, Pop Mart was successful in building a suspenseful unboxing experience to stimulate repeated purchases as consumers pursue the whole collection, saturating the Chinese toy market with mall stores and vending machines.

Classic IPs in particular became popular amongst consumers, including Molly and Skullpanda inspired design, with stocks becoming so scarce that secondary-market trading became vibrant. Following its monumental success, Pop Mart was listed in Hong Kong in 2020, raising approximately US$676 million.

The design of the new contemporary favourite — Labubus — was based on Kasing Lung’s set of illustrations, “The Monsters”, where the same fanged grin and pointy ears were then emulated and replicated by the figurines themselves.

Figure 2: Kasing Lung, Labubu’s Creator

With Lisa catalysing international demand and scaling Pop Mart’s business to the global market, Pop Mart has continued with hunger marketing: controlling to ensure restricted supply, encouraging impulsive decision-making that complements its blind-box mechanisms, capturing consumer interests and hence, enhancing perceived value. From then, celebrity exposure has multiplied and the appearance of Labubu has spread across pop culture, from LeBron James’ pink Labubu bag charm to Madonna’s Labubu-themed birthday party.

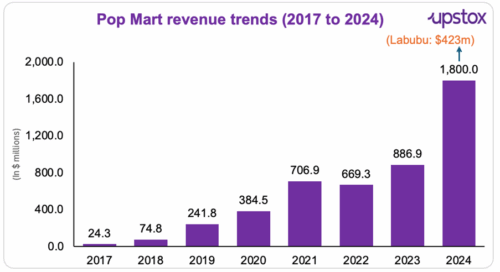

By 2025, Pop Mart’s sales have soared, achieving a 234% increase in gross profit across 2024 and 2025, as young people now find joy in the affordable, happy vibes of owning a Labubu amidst global economic uncertainties. Labubu has accounted for a significant share of total sales, encouraging the IP to surpass the toy aisle — becoming a symbol of joy and trend.

From Beanie Babies, to Fidget Spinners, to even the Dutch Tulip, the frenzy surrounding the Labubu was more than a global phenomenon. Driven by A-list celebrities and online influencers, the craze rippled through PopMart and the wider collectibles community, ingraining itself within the centre of pop-culture. Revenue and brand awareness rocketed, propelling PopMart from its foundation in Australasia to a very real challenger to established Western toy companies. However, as all trends die out, PopMart’s core challenge lies within building off this newfound popularity, turning temporary hype into durable brand equity to drive international expansion.

Retail partners, resellers, and online marketplaces experienced a surge of liquidity as Labubus sold in outrageous volumes for eye-watering amounts. For instance, a 131cm mint green Labubu figure sold for $230,000 at a Beijing auction, while secret or rare figures can be worth hundreds of dollars on reselling platforms. While investor sentiment rallied, they must remain cautious as earnings normalise in the periods following the recent downturn in demand. The majority of the consumer base formed due to hype rather than genuine collecting interests, resulting in overzealous resellers or collectors seeing a drastic depreciation of their assets as the spotlight moves beyond the doll’s iconic sharp-toothed grin. PopMart’s founder Wang Ning saw his personal net worth drop by nearly $6 billion in September due to a declining craze and oversupply of Labubu dolls, resulting in a sell-off of PopMart’s stock, wiping $13 billion from its market value. The resale value of the dolls, especially the Labubu 4.0 series, dropped by 24% across major Chinese luxury goods reselling platforms such as Dewu.

Figure 3: PopMart Found Wang Ning

Historically, collectible crazes are far from uncommon. Less common is the ability to contain the hype into a durable platform with a strong brand reputation generating stable cash-flows. NFTs, once riding the highs of the crypto craze, now a cautionary tale in boom-and-bust economics, where speculative demand surpassed intrinsic value resulting in multi-million dollar losses. Fidget Spinners highlight how fleeting novelty-driven demand can be, an unsustainable wave driving short-term cash flows for producers but ultimately fizzling out as nothing more than a nostalgic memory. PopMart aims to replicate the social media driven post-pandemic JellyCat craze, which broadened business rather than burned out. The London-based company rode the wave through subtle employed design refreshes, management of its distribution to extend its growth cycle, and expansions into Europe, placing its value within primary channels rather than secondary resellers.

Figure 4: Popularity of ‘Cute’ Cosmetic Items

Zooming out, PopMart’s stock is still up 180% YTD, with management aiming to keep the buzz alive through pre-Christmas announcements of an advent calendar and launches of newer versions and interactive models within PopMart’s broader ecosystem of collectibles. The doll’s financial legacy will depend on whether it is PopMart’s Beanie Baby moment or a more JellyCat foundation fuelling decades of growth. The craze has shown that collectibles can bear real capital flows, but only time will tell if Wang Ding’s PopMart can ride the wave and come out on top, or burn out alongside the Labubu faithful.

Labubu’s rise from niche collectible to global brand shows that successful differentiation comes not from product features alone; but from combining scarcity, cultural identity and community-driven engagement into a strategy that continually renews demand. Pop Mart embedded scarcity, probabilistic purchasing, social proof and resale culture into a single system that sustained consumer attention and elevated the brand into a half-billion-dollar phenomenon.

Figure 5: PopMart’s Skyrocketing Revenues on the Back of Labubu Craze

Counter-positioning defined the strategy by rejecting mainstream design codes and turning Labubu’s unsettling “ugly-cute” aesthetic into a marker of identity. In a category dominated by polished characters, this divergence created cultural white space that competitors could not occupy without undermining their own positioning. The blind-box mechanism reinforced distinctiveness by converting every purchase into a probabilistic event, sustaining anticipation and repeat engagement. Visibility through store queues and TikTok unboxings provided social proof, scarcity raised perceived value and sunk-cost behaviour kept collectors engaged beyond rational limits.

Community dynamics expanded demand by transforming individual purchases into social performances. Collectors circulated images, videos and trades that generated FOMO loops and reduced acquisition costs. Research on communities of consumption (Kozinets, 2001, Journal of Consumer Research) shows that consumers actively co-create value through shared practices and storytelling. Similarly, GlobalWebIndex highlights that products designed for sharing generate engagement multiples above traditional campaigns. Pop Mart designed Labubu to capitalise on these dynamics.

Emotional attachment supplied pricing power by shifting purchases from utility to self-expression, nostalgia and the psychological reward of collecting. Such attachments predict loyalty and price tolerance more effectively than satisfaction. Resale markets confirm this effect, with rare Labubu figures selling at multiples of their retail price. Pop Mart’s expects revenue to surpass 30 billion yuan (US $4.18 billion) in 2025 , underscoring the resilience of demand despite global spending slowdowns.

Figure 5: PopMart’s Cultivation of the Labubu Craze

Labubu demonstrates that differentiation can be sustained when counter-positioning, behavioural design, community engagement and emotional branding are integrated into a coherent system. For marketers, the case underlines that advantage emerges not from novelty, but from strategically cultivating the identity and scarcity surrounding the product, creating a mutually reinforcing cycle that propels overall brand image.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.