The IAA or International Mobility Show Germany, formerly known as the International Motor Show Germany, held in Munich this year is normally a tour de force for the powerhouse that is the German automotive industry, the crown jewel of its economy. However, this year, the once dominant giants of industry, Volkswagen Group, Mercedes-Benz Group, and BMW Group were now on the backfoot, defending their home market from wave of new Chinese entrants. Only a few years ago, these companies not only dominated the European market but also the Chinese one. In fact, their recent success has largely been the result of their popularity in the Chinese market. Ever since figures became available in 2008, VW has been the top brand in China, largely thanks to an early bet on the market, being one of the first foreign car companies to enter in 1984. This bet has ultimately paid off when China went on to become the world’s largest car market and now makes up over 30% of the group’s 8+ million in annual sales. However, in 2023 they lost the crown to homegrown competitor BYD for the first time.

Now, their taking the fight to VW’s home turf. After mixed reviews and disappointing sales for the first generation of EV’s from the German Big 3 and now facing pressure from the onslaught of new Chinese brands, unveiled their counterattack, their next generation of EVs. The new BMW iX3, Mercedes GLC with EQ Technology, VW ID.Cross, with competitive pricing all the technology consumers have come to expect, but is it too late?

Figure 1: Chinese brand such BYD (Left) have been expanding rapidly in Europe. Source: InsideEVs

The automotive landscape at the 2025 IAA painted a clear picture of an industry in transition. While the Germans made grabbed headlines, the show as largely dominated by the newcomers from the east. This transformation is not limited to Europe, with similar patterns are emerging across global markets, including Australia.

A casual observation of today’s roads reveals the rapid proliferation of previously unknown automotive brands. Names like GWM, BYD, Geely, and Chery have become increasingly common on Australian roads. This shift represents one of the most significant disruptions in the automotive industry since the rise Korean manufacturers in the 90s and will fundamentally alter the landscape of the global car industry.

The meteoric rise of the Chinese automotive industry has sent shockwaves through the industry. Between 2021 and 2024, the number of cars shipped from China surged by 300%, propelling China past Japan to become the world’s largest car exporter by units. In full year 2024, China produced over 31 million vehiclesand exports increased to 6 million cars, solidifying its position as a dominant player in global automotive industry.

In Europe, this rapid expansion has created genuine concern among policymakers and industry leaders, particularly in Germany where the automotive sector employs many workers. The threat of potential job losses looms large as EU manufacturers face declining market share against increasingly competitive Chinese alternatives. The market share of EVs made in China in climbed from around 3% to over 20% in the past three years.

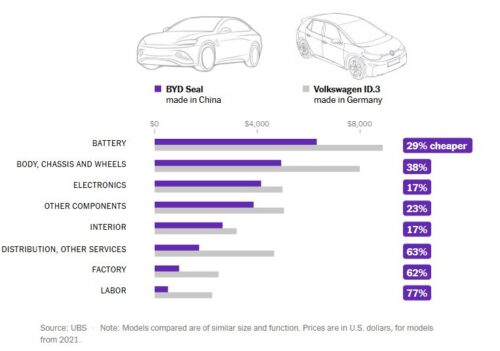

China’s largest competitive advantage is in batteries, which make up the largest proportion of cost in an electric car. The two largest Chinese battery suppliers BYD and CATL which provide the batteries to most Chinese cars and some foreign ones including Tesla’s are able manufacture batteries more advanced and more cost effectively then over economies. Fundamentally, this is because China has decades of experience manufacturing the world’s consumer electronics to develop extensive expertise in battery production. As the automotive industry has transitioned from traditional internal combustion engines which require precision mechanical manufacturing which western countries have built up decades of expertise into electric vehicles that more closely resemble electronic devices, Chinese manufacturers have found themselves uniquely positioned to capitalise on this shift, using the supply chains and manufacturing expertise they have built up allowing them to manufacture them more efficiently, reducing cost.

Figure 2: Chinese manufacturers has a cost significantly lower cost structure. Source: NYT

Additionally, Chinese companies have revolutionised automotive development cycles by embracing computer simulations over extensive real-world testing, enabling faster product iteration and reduced time-to-market. This approach, combined with more advanced and cost-effective battery technology, has allowed Chinese manufacturers to offer vehicles with superior range and performance at competitive price points. Furthermore, Chinese brands have been early adopters of Advanced Driver Assistance Systems (ADAS) and software-defined vehicle (SDV) architectures, creating more technologically advanced products than many traditional manufacturers.

It is important to note that importance of technological leadership in this phenomenon is frequently overemphasised, and large aspects of what seems better technology on the surface be may simply be due to different consumer preferences in different markets, particularly regarding software features and self-driving capabilities, where consumer preferences in Western markets differ significantly from Chinese market expectations. This is evident the struggles faced by more premium Chinese brands such as Nio, where these features are more widespread, when entering foreign markets, and the frequent criticism in reviews of features these features. However, this does not dimmish the fact that most significant and sustainable advantage lies in China’s battery supply chain dominance, which enables cost structures that Western manufacturers struggle to match, but this acts as an amplifier, not the catalyst of the trend.

Instead, the emergence of Chinese brands can be attributed to a critical gap in Western markets, the lack of affordable new vehicles. As brands like Hyundai and Kia which used to occupy this have moved upmarket in pursuit of higher margins, Chinese manufacturers have strategically positioned themselves to serve price-conscious consumers seeking reliable transportation. This market positioning mirrors the successful entry strategies, first employed by Japanese companies in the 70s and then followed by Korean brands in the 90s of entering new markets at the bottom with aggressive pricing to gain market share before increasing prices.

The second piece of the puzzle is what’s happening in the domestic car market in China. The industry’s aggressive international expansion is largely driven by intense domestic market pressures that have created an unsustainable competitive environment at home. The “Made in China 2025” policy, which includes substantial government subsidies for electric vehicle development and production, has created a hyper-competitive domestic market with over 80 Chinese automotive brands competing alongside established foreign manufacturers.

This intense competition has been facilitated by the widespread adoption of “skateboard” EV platforms and common supplier relationships that have dramatically reduced barriers to entry. Companies can now bring vehicles to market using standardised components from suppliers like Huawei for software systems, CATL and BYD for batteries, and Hesai for sensor technology. This modularisation has democratised automotive manufacturing but has also intensified price competition.

The domestic Chinese market has become characterised by brutal price wars, with many manufacturers selling vehicles at losses to maintain market share and manufacturing volumes. These business practices have resulted in the questions being asked about the long-term viability of numerous Chinese automotive brands.

Faced with razor-thin margins or outright losses in their home market, Chinese manufacturers have turned to export markets where they can command higher prices and achieve better profit margins. This export strategy serves as a crucial mechanism for compensating domestic market losses and achieving overall business sustainability. The strategy has proven successful in markets like Australia, where Chery and BYD were the two fastest growing car brands in Australia in 2024, with an increase of 114% and 64.5% in sales respectively.

Figure 3: Chinese cars such as the Nio ET9 come with advanced tech figures demanded by Chinese consumers. Source: CAR Magazine

The rise of Chinese automotive manufacturers represents a fundamental shift in the global automotive industry. Through technological innovation, manufacturing efficiency, and strategic market positioning, Chinese brands have established themselves as permanent fixtures in the global automotive landscape. While challenges remain, including trade barriers, brand building, and the need for sustainable business models, the new Chinese brand you see on the road seem to be here to stay.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.