Central banks across the globe have been the subject of scrutiny recently, with raging debate surrounding the modern need for their de jure independence. Before his re-election, Trump stated that the president should have a say in decisions made by the Federal Reserve, signalling his dissatisfaction with their independence.

In 2025, Trump has been relentless in his criticism towards the Fed, chastising chair of the Federal Reserve Jerome Powell for his failure to timely cut interest rates. Doubling down on his dissatisfaction, on August 25th, Trump fired Federal Reserve Governor Lisa Cook based on allegations of mortgage fraud, escalating the public stoush. While there has been opposition to central bank independence, a self-contained central bank is necessary to provide credibility through a non-politically motivated monetary policy and to primarily attend with the purpose of guarding long-term stable inflation.

A central bank holds several tools to promote a thriving economy while ensuring the economy doesn’t overheat. The central bank reserve can choose to manipulate the interest rate and influence inflation through other tools such as the federal funds rate and open market operations to control inflation. More recently, during extreme macroeconomic periods, such as the 2008 GFC and COVID-19, quantitative easing was used. Aggregate demand can be influenced with these tools through changes in borrowing costs and level of money supply.

These tools can enable a central bank to achieve its goal of stabilising inflation to support long-term economic growth. With independence, monetary policy can be decided without short-term political considerations and solely on economic conditions. Without independence, policymakers will face political pressures, likely from the current governing body, to lower rates artificially or to implement expansionary policies that can cause the economy to overheat and inflation to skyrocket. Households’ purchasing power will be hurt by high inflation as goods and services become increasingly unaffordable.

Central bank’s credibility is crucial for all economic agents including households, businesses, and financial markets. It is the belief, held by the public, that the central bank has the capability to achieve price stability goals and can do so in isolation. During periods of political interference like in the recent events of the Trump administration’s pressure on the Fed to lower rates, the public may perceive the Fed as subordinated to political objectives than to its own independent economic goals.

A central bank’s forward guidance gives the public insight into future policy expectations. However, the central bank’s credibility has a major influence on the effectiveness of the signalling. Forward guidance is used by households and businesses to plan when to pursue mortgages, make major investments, or get loans based on expectations of future demand and costs. A credible central bank creates a stable environment by anchoring expectations on interest rates and future price levels. Businesses and households can be misled to make major investment decisions based on incorrect signals made by a politically influenced central bank.

This “malinvestment”, a phenomenon coined by Austrian economists, occurs when businesses and households borrow heavily based on artificially low rates then suddenly faced with high rates leading to increased mortgage and loan payments. Investors want predictability from a central bank, and when there is the perception of an unstable and politically influenced economy this can lead to higher yields demanded by investors due to an increase in risk, leading to increased costs of borrowing for the government which can further destabilise the economy.

Foreign investors are more likely to invest in a country where the currency is stable and monetary policy is applied free by political pressures. An unreliable central bank will suffer from less capital inflows which are crucial in supporting domestic investment and economic growth. A key role of a central bank is to anchor expectations and reduce uncertainty. With a clear expectation on future monetary policy, economic agents can make informed financial decisions which contribute towards a sustainable and growing economy.

Moreover, an independent central bank is necessary to ensure that inflation is consistently monitored and contained. Through the use of an independent central bank, it enables the central bank to focus their efforts towards their main goal of price stability, without external influence jeopardising such achievement. Further, IMF’s central bank independence index suggests that nations with an independent central bank tend to commit to their inflation targets better than those that are not independent. As a result of independence, inflation expectations will be better managed by central banks, leading to lower levels of inflation and improved purchasing power of incomes for individuals.

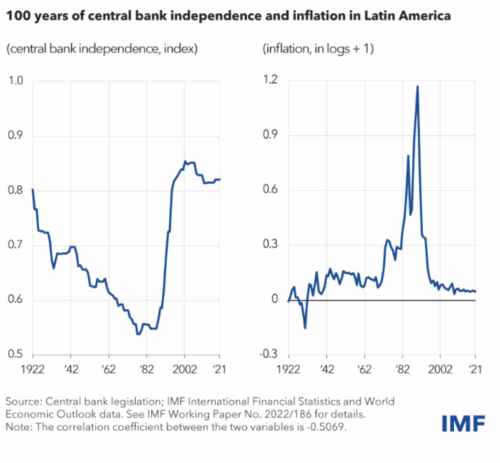

The case of Latin America exemplifies the significance of independence on inflation, with an IMF study tracking the changes in independence of Latin American central banks for the past 100 years, with a strong negative association observed between central bank independence and inflation.

Governmental interference within the central bank was at its height during the 1970s, with Latin American unsustainably borrowing from the US, sparking a debt crisis when interest rates rose. This spurred a period of fiscal dominance, coinciding with hyperinflation experienced by Nicaragua, Argentina, Bolivia, Peru and Brazil throughout the 1980s. In the 1990s, there was a transition towards legislated independence for Latin American central banks to tackle their inflationary issues, leading to a more diligent monetary policy and greater stability through adopting an independent central banking system.

Figure 1: Central bank independence and inflation in Latin America. Source: IMF

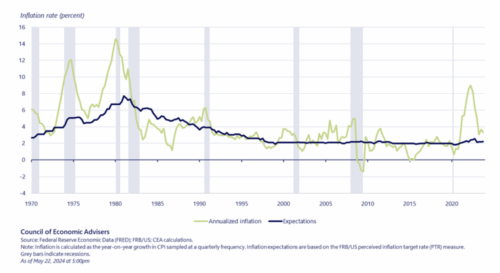

Furthermore, in the long-run, an independent central bank ensures that inflationary targets will be satisfied in the future. By anchoring inflation expectations for the long term rather than pursuing politically motivated short-run benefits, this ensures that the economy is more resistant to shocks. For example, the United States passed the Federal Reserve Reform Act of 1977, prioritising independence of the Federal Reserve and establishing the policy goal of price stability in response to a boom or bust era of high inflation.

Consequently, a period labelled as the “Great Moderation” ensued, with easing inflationary pressures and stable expectations until 2007 credited to an effective monetary policy. During this period, other countries such as Japan and England followed suit and adopted an independent central bank, experiencing similar success to the USA. Therefore, by having an independent central bank, countries can proactively regulate inflation over time.

Figure 2: Consumer Price Index (CPI) Inflation and Expectations, 1970-2023. Source: The White House

Historical evidence underscores the fact that independence and autonomy of the Federal Reserve is critical for effective and credible monetary policy. When the Federal Reserve lacked independence during the 1960s and 1970s, political influence over monetary policy led directly to the genesis of the era of the “Great Inflation.” The actions of presidents Lyndon Johnson and Richard Nixon, where significant pressure was placed by the two leaders onto the Federal Reserve to maintain low interest rates in order to finance fiscal expansions and in Nixon’s case, to rescue re-election in 1972 forced American monetary policy to remain loose despite mounting inflationary pressure.

The result of this was a 10-13% inflation rate by the late 1970s, which both decimated public trust and destabilised the American economy. However in stark dichotomy, the 1980s under Federal Reserve Chair Paul Volcker highlighted the power of independence. Despite heavy political pressure and public opposition, Volcker remained steadfast and pursued a tight monetary policy in order to break inflationary expectations. Inflation fell dramatically from above 10% to 5% in 1982. This gave rise to the previously mentioned “Great Moderation” from the 1990s to early 2000s. Cross-country data also reinforces this pattern, showing that countries with higher central bank independence have consistently lower inflation.

Ultimately, the transition towards an independent central banking system has proven to be a blessing to the worldwide economy, providing much needed solidity and reassurance for households and firms in the midst of ballooning inflationary pressures during the 1970s. An independent central bank incites confidence and reassurance in the economy and financial markets that inflation will be controlled with no political influence.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.