Going into 2025 and the second Trump Administration, investors were expecting low regulation and booming markets. Hopes of a bull market were quickly dashed by the haphazard and ever-changing tariff policy, befuddling investors, analysts, and governments alike. There has been much debate over the efficacy of such policies and what the future may hold; a look back at the past could bear fruit. The US has had a long and storied history of protectionist and isolationist trade policies, each with varying degrees of success. Which side will this latest wave fall under? History may already have the answer.

On the 2nd of February, U.S. President Donald Trump implemented universal 10% tariffs on all imports, marking what he called “Liberation Day”, with significantly higher tariff rates on a number of important trading partners such as China, the European Union and Vietnam. These measures included specific tariffs on critical goods such as medical equipment, raw materials, and consumer goods.

Although some of these tariffs were later paused, these aggressive and targeted tariff policies triggered trade wars, most notably with China, where U.S. tariffs went up to as high as 145%. What proved to heighten inflationary and recessionary risks, Trump justified his aggressive tariffs as a means to offset the revenue gap created by tax cuts, reduce the trade deficit, protect U.S. sovereignty, and enhance national and economic security.

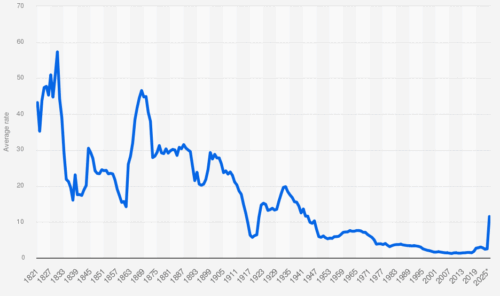

Figure 1: Trump Tariffs vs. Past U.S. Tariffs In History

Alongside this, renewed attention was drawn to the Jones Act, a century-old federal law requiring goods shipped between U.S. ports to be transported on ships built, owned and operated by U.S. citizens and residents. The Jones Act, initially introduced by Wesley Jones in 1920, was launched to revitalise the U.S. maritime shipping industry, create jobs, and boost revenue. While Trump has historically waived the Act, the administration has recently sought to take a favourable stance on the Jones Act.

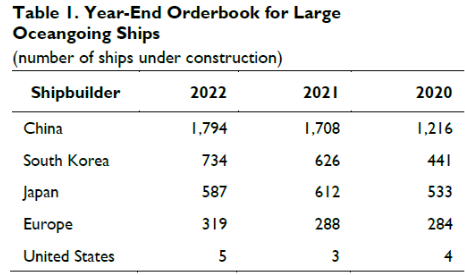

Trump’s passion was reignited by wanting to “restore America’s Maritime Dominance” through revitalising domestic maritime industries and promoting national security and economic prosperity. Further to this, Trump’s plan to revitalise the U.S. maritime commerce industry and build more ships included the imposition of additional multimillion-dollar fees on Chinese ships importing goods to the U.S. These measures were framed as both a punitive trade action and strategic efforts to revitalise the shipping industry.

Figure 2: Number of Ships Under Construction

Whilst intended to revitalise the U.S. shipping industry, critics argue that the protectionist nature of legislation, which significantly increases the cost of shipping goods, serves more of a burden than a benefit to the broader economy. Rather than bolstering national security and economic prosperity, critics contend that the Jones Act has stifled domestic shipbuilding, reduced the size of America’s merchant marine reserve, and reduced the nation’s ability to effectively respond to disasters.

Additionally, higher domestic costs for shipping parts, compared to lower-cost alternatives internationally, compound these issues, alongside non-monetary impacts such as freight costs, traffic congestion, and environmental pollution. Ultimately, the debate over the Jones Act, which resonates with the Trump administration, highlights the complex trade-offs between protecting domestic industries and fostering economic efficiency.

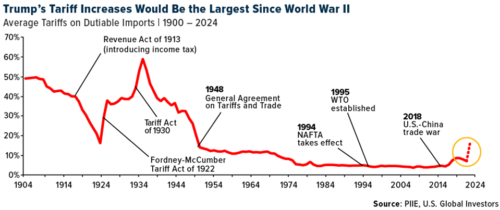

Tariffs have long been a tool in the U.S. economic arsenal, wielded to protect domestic industries, retaliate against foreign policies, or address trade imbalances. Understanding differences and similarities between the recent Trump tariffs and past watershed events, such as the Smoot-Hawley Tariff Act and the Chicken Tax, can perhaps help us better understand both the purpose and potential effect of what’s currently happening.

The Smoot-Hawley Tariff Act took place in 1930, raising duties on over 20,000 goods, raising average rates of tariffs to nearly 60% on dutiable imports. Although it was priced allegedly to favour American farmers during the 1929 Great Depression, it backfired and led to the decline of two-thirds of the U.S. exports and imports in 1933. As a result, more than 25 nations imposed retaliatory tariffs, and world trade decreased by 66%, further deepening the global depression.

Figure 3: Average Tariffs on Duitable Imports

Decades afterwards, in 1964, the Chicken Tax was passed in relation to European tariffs on U.S. Chicken. The U.S. retaliated in like manner against light truck imports by way of a 25% tariff. It was intended to be temporary, but the truck tariff has never been repealed. US producers now enjoy over 80% market share of pickups, as international producers such as Toyota were forced to build US plants in an attempt to avoid the tariff. That kind of tariff distorted competition for decades, demonstrating how one retaliatory measure can cement pre-existing long-term market inefficiencies.

Figure 4: Toyato Factory in the U.S.

Trump tariffs in 2018 levied more than $550 billion worth of Chinese imports with 10-25%, and an additional 145% on select goods, targeting sectors like steel, solar panels and EVs in 2025. Tariffs were intended to rectify trade deficits and IP robbery, but led to retaliatory tariffs and rising costs.

Projected by Goldman Sachs, the trade war will decelerate the GDP growth of China to 4.0% in 2025, down from a 4.5% estimate in 2024, while the U.S. GDP growth forecast has been cut to 1.7% from a previous estimate of 2.4%, citing worsening trade policy risks and rising tariffs.

The sequence is plain: previous tariff occurrences usually provide temporary protection but come at the ultimate expense. The Smoot-Hawley intensified the Depression-era solitude. The Chicken Tax warped auto markets for 60 years. Trump’s tariffs, though concentrated on economic clout, stretched international supply chains and charged customers. These cases highlight the worth of measured, multilateral trade policy. Experience tells and history teaches that protectionism comes at a cost, one long paid out after its political sheen.

When do tariffs actually achieve their stated purpose? The current consensus is that while universal tariffs are ineffective, targeted tariffs where there is a competitive domestic industry present are. However, history tells a different story.

In 1963, as retaliation for tariffs on American poultry products by the EEC as a part of the “Chicken War”, President Lyndon B. Johnson implemented a 25% tax on all light trucks imported into the US. This was mainly targeting the Volkswagen Type 2, which at the time was wildly popular with the hippie counterculture movement in full swing.

On the surface, this policy was a huge success. Basically, all light trucks sold in the US are manufactured in North America, and the market is dominated by US companies, with Ford, General Motors (owner of Chevrolet and GMC), and Stellantis (owner of RAM Trucks) making up 80% of light truck sales in the US.

This is particularly impressive given the popularity of such vehicles in recent times, with models such as the Ford F150 and Chevrolet Silverado frequently topping sales charts. It may seem that this policy decision was a resounding success, not just protecting the domestic car industry but positioning it for future success. After all, the original target of the tariff, Volkswagen, ceased selling light trucks in the US in 2003.

Now, more than 60 years on, the full impact can be seen. Once some of the largest companies in the world, US car companies’ global presence has dramatically declined, and they are now no match for even the largest car companies from Europe or Asia. In fact, the largest exporter of cars out of the US is now BMW, not the Detroit “Big 3”. This may be a case of the chicken and the egg.

After the Chicken Tax was implemented, the domestic manufacturers were incentivised to prioritise and promote the pickup trucks and large SUVs, where they were shielded from competition and could chase higher margins.

In fact, the rise in new car prices can be largely traced back to the popularity of such vehicles. As a result of this, the Big 3 effectively conceded the passenger car market to foreign firms to prioritise what is essentially a niche product outside of North America, which has been detrimental to their export potential and global footprint.

Figure 6: Congress Members Destroy a Toshiba Boombox

The automotive sector also gives us the prime example of what could be considered the most successful tariff policy, the Plaza Accords. Frustrated with the rise of the Japanese auto and electronics industry, President Ronald Reagan threatened to impose 100% tariffs on Japanese cars and electronics. Fearing losing their largest market, the Japanese government was forced to come to the negotiating table and agree to the Plaza Accords.

In a historic act of currency intervention, signatories agreed to appreciate their currencies in order to effectively depreciate the USD, making US exports more competitive on the global market. For America, this was an astounding success, and the US saw its trade balance fall from $152bn in 1987 to $30bn in 1991. It seems like the US may be heading towards a new Plaza Accords with China. Still, given their lack of political influence over China, a political rival, compared to Japan, a close ally, it is unlikely.

Figure 7: Trade Weighted U.S. Dollar Index: Major Currencies

In general, the Trump Administration’s tariff and protectionist policies bring to mind historical events like the Smoot-Hawley Act, the Chicken Tax, and the Plaza Accords, each with complex, lasting implications. Tariffs can yield short-run domestic benefits or be leveraged as a means of negotiation, but history teaches us that the policies too often trigger distortion and retaliation, further leading to economic inefficiency.

The 2025 US tariffs imposed by Trump, as much as they are ambitious to national security, economic revitalisation, and trade imbalance correction, can see history repeat itself by firing up trade tensions and damaging American consumers and suppliers at the same time. In today’s era of globalisation, where global supply chains are closely interconnected, a retaliatory and unilateral tariff can be expensive and damaging to the overall long-term economic health. Ultimately, multilateral coordination, careful diplomacy and policy enhancement might be the key to yield better and healthier trade outcomes for all.

Beattie, A. (2025, April 17). Trump’s auto tariffs build on a long destructive history. @FinancialTimes; Financial Times. https://www.ft.com/content/a2aa265f-c852-43cd-804f-f175c24c5248

Clarke, J. (2025, April 23). What are tariffs and why is Trump using them? BBC. https://www.bbc.com/news/articles/cn93e12rypgo

conversableeconomist. (2024, April 24). The Jones Act: Consequences of a Destructive Industrial Policy – Conversable Economist. Conversable Economist – in Hume’s Spirit, I Will Attempt to Serve as an Ambassador from My World of Economics, and Help in “Finding Topics of Conversation Fit for the Entertainment of Rational Creatures.” https://conversableeconomist.com/2024/04/24/the-jones-act-consequences-of-a-destructive-industrial-policy/

Duignan, B. (2019). Smoot-Hawley Tariff Act | History, Effects, & Facts. In Encyclopedia Britannica. https://www.britannica.com/topic/Smoot-Hawley-Tariff-Act

Frankel, J. (2015). The Plaza Accord 30 Years Later. https://scholar.harvard.edu/files/frankel/files/plazaaccord-piie2016.pdf

GERSTENZANG, J. (1987, April 18). 100% Tariff Put on Some Japan Goods : Reagan Move to Halt Chip Dumping Could Double TV, Computer Prices. Los Angeles Times. https://www.latimes.com/archives/la-xpm-1987-04-18-mn-1024-story.html

Goldman Sachs. (2024, November 20). Macro Outlook 2025: Tailwinds (Probably) Trump Tariffs. Goldmansachs.com. https://www.goldmansachs.com/insights/goldman-sachs-research/macro-outlook-2025–tailwinds–probably–trump-tariffs

Grabow, C., Manak, I., & Ikenson, D. (2018, June 28). The Jones Act: A Burden America Can No Longer Bear. Cato Institute. https://www.cato.org/publications/policy-analysis/jones-act-burden-america-can-no-longer-bear

Greco, J. (2024, September). What Is the Jones Act? U.S. Naval Institute. https://www.usni.org/magazines/proceedings/2024/september/what-jones-act

Grenville, S. (2024). A US dollar deal? Explaining a lack of enthusiasm for a Plaza Accord redux | Lowy Institute. Lowyinstitute.org. https://www.lowyinstitute.org/the-interpreter/us-dollar-deal-explaining-lack-enthusiasm-plaza-accord-redux

Hameiri, S. (2025, April 4). Trump’s tariffs explained. UQ News. https://www.uq.edu.au/news/article/2025/04/trumps-tariffs-explained

Hartigan, L., Rollo, S., Tyazhelnikov, V., & Yadav, P. K. (2025). Trump’s tariff and trade war: experts react. The University of Sydney. https://www.sydney.edu.au/news-opinion/news/2025/04/09/trumps-tariff-and-trade-war-experts-react.html

Hendricks, D. (2025, March 4). President Trump’s Executive Order on Shipbuilding. Americanmaritimepartnership.com. https://www.americanmaritimepartnership.com/general/amp-statement-on-president-trumps-executive-order-on-shipbuilding/

Hikosaka, S. (2021). Smashing Toshibas: A Tale of Trade War, Cold War, and Japan-Bashing – 1980s Politics, Culture, and Memory. Cornell.edu. https://blogs.cornell.edu/1980s/2022/06/26/smashing-toshibas/

Ince-Cushman, D. (2025, February 17). Marketing Genius — You were conditioned to like SUVs due to Chicken Tariffs! Medium. https://medium.com/@d.incecushman/marketing-genius-you-were-conditioned-to-like-suvs-due-to-chicken-tariffs-2cadcc327e8d

Kenton, W. (2019, July 9). What Is the Smoot-Hawley Tariff Act? Investopedia. https://www.investopedia.com/terms/s/smoot-hawley-tariff-act.asp

Kenton, W. (2024, June 18). The Jones Act. Investopedia. https://www.investopedia.com/terms/j/jonesact.asp

Lockett, H. (2025, May 19). Breakingviews – The post-truce state of US-China trade looks dire. Reuters. https://www.reuters.com/breakingviews/post-truce-state-us-china-trade-looks-dire-2025-05-19/

Lynch, D. J. (2025, March 23). Trump wants to build more ships in the United States. It’s not so simple. The Washington Post. https://www.washingtonpost.com/business/2025/03/23/trump-shipbuilding-fees-china/?

Miller, C. (2025, April 11). The 25 Bestselling Cars, Trucks, and SUVs of 2025 (So Far). Car and Driver. https://www.caranddriver.com/news/g64457986/bestselling-cars-2025/

Monkton, R. H. (2025, May 1). PROJECT 2025 AND CHINA. The Postil. https://www.thepostil.com/project-2025-and-china/?print-posts=pdf

Office of The Historian. (2025). Protectionism in the Interwar Period. History.state.gov. https://history.state.gov/milestones/1921-1936/protectionism

Olney, W. W. (2020). Cabotage sabotage? The curious case of the Jones Act. Journal of International Economics, 127, 103378. https://doi.org/10.1016/j.jinteco.2020.103378

Palma, S. (2025, May 19). Scott Bessent warns of maximum tariffs as US takes tougher line on trade talks. @FinancialTimes; Financial Times. https://www.ft.com/content/1a69dff7-6513-44f3-850d-5a19a18683f2

Phang, S. (2025, April 15). China’s Economy Set to Take Hit From Tariffs. Bloomberg.com; Bloomberg. https://www.bloomberg.com/news/newsletters/2025-04-15/china-s-economy-set-to-take-hit-from-tariffs

Price, A. (2023, December 4). Chickens, Trucks, and Tariffs: A 1960s Trade War | In Custodia Legis. The Library of Congress. https://blogs.loc.gov/law/2023/12/chickens-trucks-and-tariffs-a-1960s-trade-war/

The Economic Times. (2024). Business News Today: Read Latest Business news, India Business News Live, Share Market & Economy News. The Economic Times. https://economictimes.indiatimes.com/?back=1

The Economist . (2019, May 23). As the trade war heats up, China looks to Japan’s past for lessons. The Economist. https://www.economist.com/finance-and-economics/2019/05/23/as-the-trade-war-heats-up-china-looks-to-japans-past-for-lessons

The Feed. (2025, March 12). Goldman Sachs slashes U.S. economic outlook as Donald Trump’s new tariffs send shockwaves through global m. The Economic Times; Economic Times. https://economictimes.indiatimes.com/news/international/us/goldman-sachs-slashes-u-s-economic-outlook-as-donald-trumps-new-tariffs-send-shockwaves-through-global-markets/articleshow/118938883.cms?from=mdr

The White House. (2025a, April 2). Fact sheet: President Donald J. Trump declares national emergency to increase our competitive edge, protect our sovereignty, and strengthen our national and economic security. The White House. https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/

The White House. (2025b, April 9). Restoring America’s Maritime Dominance. The White House. https://www.whitehouse.gov/presidential-actions/2025/04/restoring-americas-maritime-dominance/

Thiagarajan, R., Bender, J., & Metcalfe, M. (2025). The price of protectionism: Understanding the economic tradeoffs of tariffs | State Street. State Street. https://www.statestreet.com/us/en/asset-manager/insights/price-of-protectionism-economic-tradeoffs-of-tariffs

Thorbecke, W. (2023). U.S. trade imbalances, East Asian exchange rates, and a new Plaza Accord. Asia and the Global Economy, 3(1), 100054. https://doi.org/10.1016/j.aglobe.2023.100054

Tierney , A. (2025, May 15). U.S. tariffs – statistics & facts. Openathens.net. https://www-statista-com.eu1.proxy.openathens.net/topics/13216/us-tariffs/

Wilmot, S. (2025, March 19). The 1960s “Chicken Tax” Shows the Lasting Impact of Tariffs. WSJ; The Wall Street Journal. https://www.wsj.com/economy/trade/the-1960s-chicken-tax-shows-the-lasting-impact-of-tariffs-aad04b6a

writer, G. (2025, March 18). Tariff war might not go the way we hope. Farmers Weekly. https://www.farmersweekly.co.nz/opinion/tariff-war-might-not-go-the-way-we-hope/

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.