China’s tenacious, multi-trillion-dollar economy – once defined by its rapid growth rates and robust domestic consumer bases – now struggles to regain its former glory. Following the COVID-19 pandemic, most countries loosened their stringent policies in anticipation of a booming pent-up domestic demand. While the majority mirrored expectations – as reflected by the rise in global inflation rates – China encountered crippling deflationary pressures as general price levels fell, and the economy weakened. China’s once-powerful consumer demand plunged, leading to destructive ripple effects on domestic businesses across all scales. The deflation in China can be attributed to decreasing consumer confidence, as well as a volatile housing market and high propensities to save.

The declaration of bankruptcy by Evergrande had a significant impact on consumer confidence levels, as the real estate market makes up 30% of China’s GDP. Evergrande, a prominent real estate developer, filed for Chapter 15 bankruptcy protection in New York, with liabilities of up to $328bn, leaving suppliers and workers unpaid, projects unfinished, and clients without their promised properties. Instabilities within the housing market, coupled with China’s record-high, post-pandemic youth unemployment rates, warranted the reduction in consumer confidence and low domestic demand. Retailers that stockpiled inventories in preparation for the anticipated post-pandemic demand spike had to cut prices (by around 3-5%) in order to sell off large volumes of existing stocks. Moreover, the growing affinity to invest in liquid assets such as low-risk bonds and high-yield savings accounts further enhanced deflationary pressures. This article aims to explore the deflationary pressures plaguing the Chinese economy, including its driving forces, implications, and possible recovery strategies moving forward.

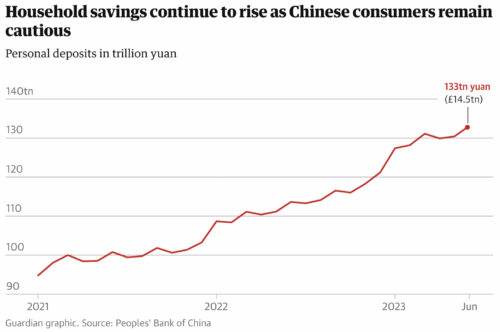

China has diverged from global macroeconomic trends, which saw a surge in consumer spending following years of COVID restrictions. Instead, household savings have surged to reach record highs. The savings rate is defined as the proportion of disposable income net of adjustments related to employment-related pension entitlements and final consumption expenditure. Chinese gross household savings rate has loomed at around 35% from an all time high of 38.5% in 2010, a sharp contrast from the 19.8% savings rate of Australian households for the same time period.

Aggressive expansionary monetary policy by the People’s Bank of China has not been able to induce an increase in consumer spending. One of the central bank’s key interest rates, the one-year loan prime rate, has been lowered for the second time in 3 months to 3.45%, at a time when the majority of other central banks are raising interest rates to combat runaway inflation in their economies. With low interest rates having no significant impact on successfully boosting consumer confidence, it is important to explore factors beyond economic indicators that may be influencing consumer spending patterns.

The Chinese have long been savers; fast economic growth and weak social safety nets have left households with little choice but to manage their finances frugally. However, the COVID-zero policies adopted by the Chinese government seem to have perversely impacted household and small business confidence. Thus, the ‘animal spirits’ guiding economic decision-making in the economy have been driven by significant fear regarding the health of the economy.

Source: The Guardian

Shattering confidence in the market has led to consumers cutting back on spending on material items such as white goods and real estate, as well as investments in liquid assets. Adding to the government’s crackdown on over-leveraging, China’s biggest developer, Country Garden, teeters on the edge of default. With real estate accounting for about 30% of China’s GDP, its decline has certainly put the brakes on the economy.

Major economic news coming out of the second largest economy of the world will undoubtedly grab global attention. The burning question on the minds of policy makers, C-Suite executives, and the general public is how China’s economic woes will affect the global economy. Most importantly, the question raised is whether China will export its deflation?

Meaningful export of deflation can come in three ways;

World oil prices have largely remained unchanged even though the Chinese economy has visibly slowed down, and transportation metrics in the country have remained stable. Therefore, the first channel is an unlikely occurrence.

The Renminbi is weaker than it was at the start of the year, and policy announcements have clearly signaled the government’s stance to avoid further devaluation of the currency. A weaker Renminbi would make Chinese exports more competitive and appealing in global markets. However, this may not sit well with China’s largest trading partner, the US, which may not react favorably to increased competition from Chinese exports for its domestic products, especially with an impending General Election that could lead to protectionist policies against Chinese imports.

Prices of exported goods may not necessarily correlate with broader domestic price drops, and it’s unlikely that Chinese exporters will significantly reduce prices for foreign customers. However, major European corporations relying on Chinese demand for about 10% of their profits could see the Chinese downturn affecting the global economy through a drop in production.

The slump in the industrial sector, especially with regards to capital expenditure in the economy, cannot guarantee the insulation of the global economy from negative spillovers. While the extent of deflation may be small, it will still be noticeable. With central bankers elsewhere engaging in a relentless cycle of rate hikes through contractionary monetary policy, any forces that may lower their price levels will certainly be welcomed graciously, regardless of their sources.

Emerging from an economic shutdown caused by strict pandemic policies, consumer confidence levels have fallen back to pandemic levels, a sign that China’s post-pandemic surge is wavering. In an attempt to reinvigorate consumer spending, China has taken an approach to increase monetary stimulus in the form of benchmark interest rate cuts to stimulate aggregate demand. Despite this approach, China’s central bank is facing constraints on its ability to provide monetary stimulus, mainly due to elevated debt levels arising from failed large infrastructure and real estate development programs. The excessive amount of debt circulating around the Chinese economy is raising concerns about the leadership’s ability to stimulate the economy and its effectiveness.

According to Eswar Prasad, a professor of trade economics at Cornell University, “building confidence among consumers” in the private sector is essential to China’s recovery. By doing so, households will be able to spend more and forgo a high savings rate brought about by weakened social safety nets. This could be enacted through expansionary fiscal stimulus with shorter decision and transmission lags such as tax benefits, which could incentivise business and individuals to invest in more capital expenditure and encourage spending on goods and services. Confidence could also be boosted with raising government debt via the issuing of debt securities such as government bonds, as a government budget could stimulate the economy via funding public projects and managing liquidity. However, debt levels in China are already exceedingly high, and the accumulation of too much debt risks an even greater degree of debt-driven inflation.

This is not the first time China has slid into a deflationary economy. In 2002, deflation occurred in China due to demand and supply side factors such as inefficiency, price competition, and excess capacity in private sectors. To combat this deflation, China implemented supply side measures, which involved addressing the issue of overcapacity in certain industries which would indirectly promote a more efficient resource allocation domestically. Structural reform was also pursued, where China opened up to foreign investment, which in turn allowed businesses to become more resilient to deflationary pressures through overseas consumer spending, and less dependency on domestic confidence. In current times, China is yet to allow a greater degree of foreign imports due to a local protectionism policy, whereby an economic blockade disallows domestically sourced materials to be traded overseas. Perhaps economic reform may be required again, where the removal of China’s protectionism is needed to combat China’s current deflationary episode.

China is not the only country to have faced deflation in recent years. In 2008, USA faced the threat of deflation as part of the financial crisis, with consumer prices dropping 1.7% in November 2008. In response, USA implemented aggressive monetary policy schemes, with interest rate cuts reaching a near-zero range, along with unconventional monetary policy methods that saw quantitative easing and extended liquidity programs. The combination of these policies at that time successfully managed to stimulate the US economy and promote domestic economic growth. However, it is important to note that the effectiveness of these measures is largely dependent on the health of the overall economy, suggesting that it is not possible for China to replicate these implementations on a one-for-one basis. Consumer confidence arising from strict COVID policies, paired with mounting levels of debt due to a failing housing market, make it exceedingly difficult for China to pursue similar monetary policy routes, overall making it challenging for China to tackle deflation.

To conclude, the devastating deflationary pressures experienced by the Chinese economy – the second largest in the world – sustain overwhelming implications for local and global economies alike. While global economies experienced spiking inflation, the Chinese economy, following the easing of COVID-zero regulations, concurrently underwent a rapid descent in consumer confidence. This stark contrast was primarily attributed to the economy’s low household spending combined with ineffective monetary policy strategies employed by the PBOC. However, despite China’s global scale deflationary pressures, it remains unable to rely entirely on export markets to curb the subsequent negative spillovers. Failing monetary and unreliable deflation-exporting policies may force China to adopt expansionary fiscal policies to both increase prices and boost consumer confidence and spending via tax cuts. Overall, deflationary recovery may only improve over time if the economic policies align with the health and confidence of the Chinese economy.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.