Introduction: The IMF and Conditionality

Amidst international economic uncertainty, the International Monetary Fund (IMF) once again finds itself in the spotlight. Considered by many as the world’s most crucial economic institution, the IMF has provided loans exceeding $700 billion to 150 countries throughout its 80-year history, all in pursuit of its objective of achieving macroeconomic stability (The Economist, 2023). In the wake of the oil and debt crises of the 1970s and 1980s, the IMF frequently assumed the role of a lender of last resort for nations grappling with economic turmoil, particularly low and middle-income countries facing balance of payments deficits (Abbot et al., 2010). Today, with the escalating costs of servicing debts due to global interest rate hikes and the strengthening of the US dollar, an increasing number of economies find themselves turning to the IMF for assistance, or struggling to repay their existing loans.

IMF bailouts and loans are notorious for their conditionality, defined as the economic adjustments a nation must undertake in return for IMF funding. The IMF asserts that these conditions aim to help countries address their underlying balance of payments issues without detrimentally impacting national prosperity (IMF, 2023).

Over time, the nature of these conditional loans has evolved, with structural conditionality gaining prominence in the mid-1980s and expanding further through the IMF’s enhanced lending facilities in the 1990s. These adjustments encompassed measures such as the privatisation of state-owned enterprises, anti-corruption initiatives, legal reforms, and institutional transformations within the financial and banking sectors. However, the proliferation of such conditions has faced significant criticism, as they were perceived to undermine national ownership, exacerbate income inequality, and be applied rigidly and ideologically (Abbot et al., 2010). Consequently, the IMF revised its conditionality guidelines in 2002, emphasising the importance of country ownership, individual policy goals, and the “criticality” of any imposed condition. Nevertheless, the number of conditions imposed by the IMF has continued to rise steadily, raising doubts about the impact of these updated guidelines (Ban & Gallagher, 2014).

Empirical evidence is lacking to support the notion that conditions enhance the success of programs or promote ownership (Dreher, 2009). The problem with conditions lies in the fact that if governments are committed to sound management practices, conditionality becomes unnecessary, whereas, in the absence of commitment, compliance is unlikely. Even when compliance does occur, conditions tend to disproportionately harm the “human” aspects of the economy. Despite the increasing availability of various financing options in today’s world, many countries still exhibit a preference for opting into IMF loans, even with attached conditions (Easton & Rockerbee, 1999).

Moreover, the manner in which conditions are established is perceived as unfair. Research indicates that politically influential countries, as indicated by their temporary membership in the UN Security Council, have received 30% fewer conditions between 1992 and 2008. This suggests that the IMF may be willing to trade off conditionality for global political influence, raising doubts about its commitment to high-minded principled goals (Dreher et al., 2015).

As a lender of last resort, the IMF’s role within the global economy could inadvertently incentivize reckless economic management, as the consequences of a crisis are less severe when the IMF intervenes compared to a counterfactual scenario where it does not. Nonetheless, there are still inherent incentives to avoid such crises, and conditions aim to discourage future risky behaviour, even in cases where it does occur.

To further contextualise the above findings, this essay will examine two case studies of the IMF’s performance: one that is considered a success and another that is generally regarded as a failure.

A Defence of IMF Intervention in the Asian Financial Crisis

The effectiveness of the IMF is, at the best of times, opaque. Despite the prevailing scepticism about the organisation, there have been instances where its interventions were largely successful. To illustrate one of its notable achievements, we will delve into the IMF’s role in the resolution of the Asian Financial Crisis (AFC).

The IMF’s involvement in the AFC primarily spanned from 1997 to 1998. The origins of the crisis were complex, as it affected various Asian countries, from Korea to Malaysia. Broadly categorised as a currency crisis, the AFC witnessed rapid and severe devaluation of Asian currencies, leading to withdrawal of foreign capital, soaring cost of debt, and a loss of market confidence. In response, the IMF implemented a range of measures, including loans, restructuring initiatives, and consultations, which ultimately helped rescue many Asian economies from the crisis, setting the stage for the “Asian century.”

A critical factor contributing to the IMF’s success was its ability to restore investor confidence in Asian markets. Particularly in Korea, the provision of debt by the IMF and its efforts to persuade G-7 financial institutions to extend outstanding loans for a limited period significantly improved market sentiment (Koo, 2006). This, in turn, prevented substantial capital outflows. Thus, any form of IMF intervention carried significant value, as it reassured investors and financial institutions.

However, it is important to note that IMF intervention can also generate adverse market reactions. In the case of Thailand, a significant portion of IMF capital was used to prop up an inflated property market, which drew international attention to the housing bubble and triggered a rapid outflow of foreign capital (Bello, 1999). This sudden withdrawal of capital weakened an already fragile economy. While this underscores the potentially negative impacts of IMF intervention on investor sentiment, the wider context must be acknowledged; over the longer term, Thailand witnessed a robust economic recovery after IMF intervention, with the return of foreign capital by 1999 (Chalongphob Sussangkarn, 2011). This suggests that the persuasive effects of IMF intervention are likely defined, in the longer term, by the success of said interventions.

Furthermore, it is worth noting that the IMF, like the global economy, is influenced by the United States. Throughout the AFC, the IMF was able to collaborate with the US Treasury to restore investor confidence (Koo, 2006). As a result, IMF support carries the added weight of US Treasury backing, further bolstering its image. Ultimately, markets generally favour a struggling economy with US-backed IMF support over a struggling economy without such backing.

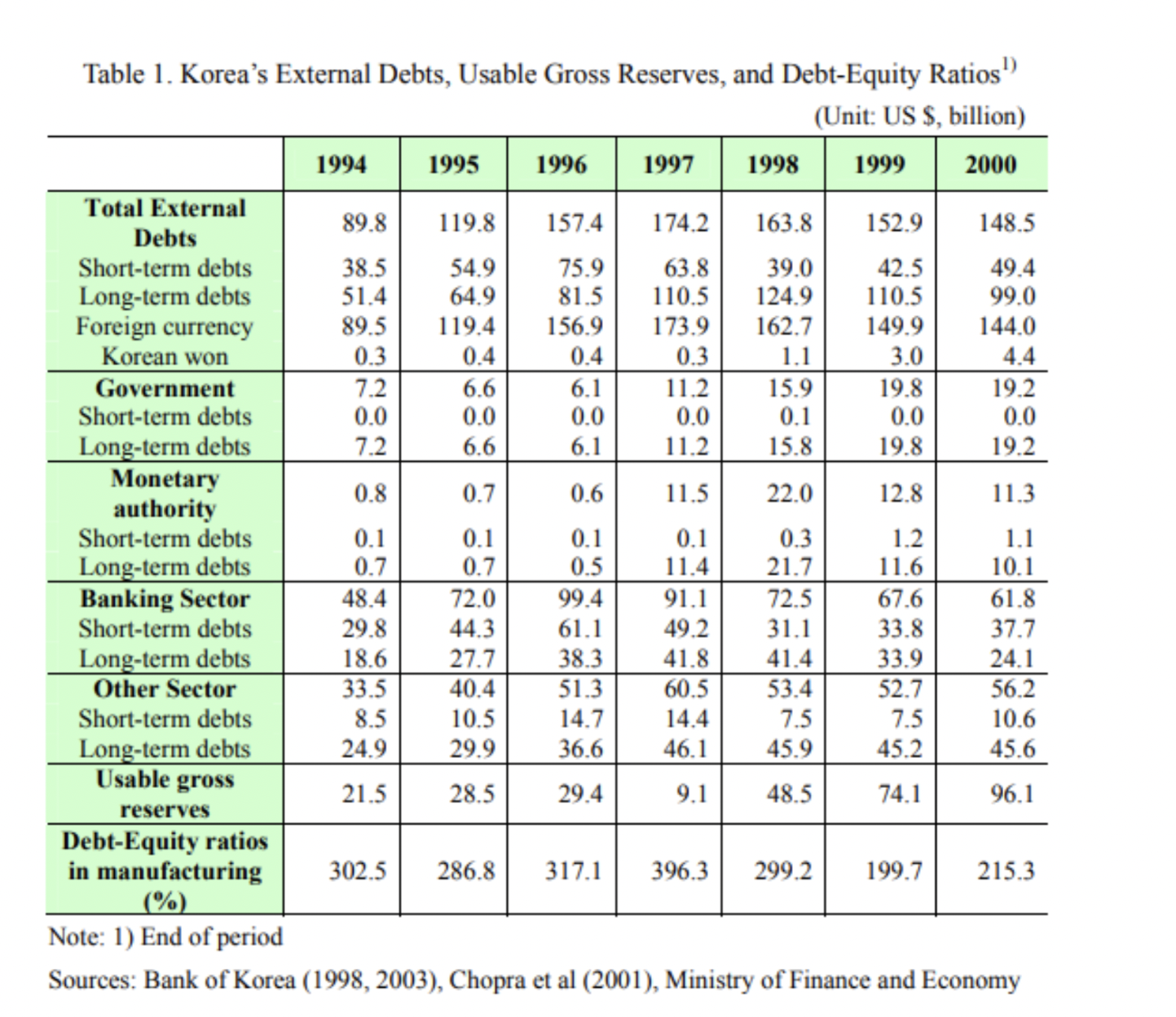

The positive impacts of the IMF extend beyond the initial morale boost. One of the key elements of the IMF’s modus operandi is to transform a flagging nation’s regulatory and corporate governance landscape. The Korean government, for instance, was compelled to create regulatory bodies, such as the Financial Supervisory Commission, cut spending in key areas and restructure its debt during the AFC (Koo, 2006) . These policies had tangible outcomes as illustrated in the chart below.

Indeed, following the IMF interventions of 1997 and 1998, there was a notable decrease in Debt-Equity ratios and a significant increase in usable gross reserves. These developments are crucial for safeguarding economies against currency collapse (Dornbusch et al., 1995). Similar success stories can be observed across other affected Asian countries (Finance and Development, 2023). Hence, despite the torrent of negative publicity that the IMF receives, it must be admitted that in the late 1990s, IMF intervention helped sustain and enhance the Asian miracle that continues to this day. Therefore, the examination of the AFC demonstrates that while the IMF cannot be deemed flawless, instances of its success are not entirely absent.

Transitioning from the study of the Asian Financial Crisis (AFC) to the examination of a less successful instance, attention will now be turned to the IMF’s involvement in Ecuador, highlighting the shortcomings of IMF lending programs.

The IMF in Ecuador: A Critique

In March 2019, the IMF approved a $4.2b (IMF, 2020) loan to Ecuador, with the aim of fostering economic development and stability. Notably, the loan was under the provision that authorities would adhere to a set of recommendations spelled out by the IMF.

As noted above, the imposition of structural adjustments and conditionality by the IMF often proves to be ineffective or even detrimental for the nations involved. In the case of Ecuador, the fiscal tightening measures required by the IMF were expected to increase poverty and unemployment, pushing the country into a recession (Weisbrot, 2019). The IMF argued that these measures would be offset by long-term gains in private sector inflow, but even the IMF acknowledges its historical tendency to be overly optimistic in growth assumptions (IMF, 2018).

A sector that commonly bears the brunt of IMF loan conditions is healthcare. Studies, such as a 2017 publication in Public Health Reviews, have shown that the fiscal parameters related to healthcare spending in structural adjustment programs have overall negative effects on child and maternal health (Thomson et al., 2017). Ecuador experienced similar adverse health impacts under the austerity measures imposed by the IMF, which were exacerbated by the pandemic. The initial $4.2 billion loan was approved against the backdrop of a significant 64% reduction in healthcare spending from 2017 to 2019, resulting in the mass layoff of public healthcare workers, including doctors, social workers, and nurses (Salgado & Fischer, 2020). Predictably, these cuts overwhelmed the Ecuadorian healthcare sector during one of the deadliest outbreaks globally.

Some scholars argue that the policies imposed by the IMF are, in fact, responsible for the negative situations that lead countries to seek IMF loans in the first place (Reinsberg et al., 2021). The excessive degree of structural reform imposed often hinders the implementation of recommended policies and can even cripple nations following poorly executed IMF lending programs. This leaves the affected countries in dire situations as investor confidence dwindles, forcing them to return to the IMF for further loans. In a way, the IMF designs policy prescriptions that nations almost inevitably fail to adhere to, resulting in adverse market conditions and perpetuating a cycle of dependency on the IMF.

Some posit that these conditions are intentionally painful and difficult to adhere to in order to mitigate moral hazard – in other words, countries would lack the incentive to pursue sound macroeconomic policies if the option IMF assistance is not particularly unpleasant (Reinsberg et al., 2021). Others argue that the IMF simply fails to accurately anticipate the challenges of policy implementation in the specific political economy of the country in question.

Examining Ecuador’s case, it appears to align closely with these observations. Due to the policy recommendations of the IMF, Ecuador’s healthcare system was severely weakened, rendering it ill-prepared to handle the COVID-19 crisis (Corckery, 2020). Under this backdrop Former president Lenin Moreno found himself in a particularly challenging situation, scrambling to cover around $17b of international debt that the nation had accrued. The result was Ecuador returning to the IMF, cancelling the initial $4.2b loan, instead opting to negotiate a new 27-month Extended Fund Facility loan of $6.5b (IMF, 2021).

Like Ecuador, many nations find themselves unable to escape arduous situations despite decades of IMF intervention. While multiple factors contribute to this predicament, it is worth considering that the implementation of IMF lending programs themselves may require significant improvements or even a complete reconsideration of the concept of development.

Conclusion

Whether you believe IMF loans and conditions have a positive role in the world economy or not, they provide crucial options for countries who find themselves with few others left. A key purpose of conditions is to help provide creditors security and confidence that they will be able to recover their capital. Therefore, in their absence two consequences are likely: higher interest rates (reflecting the perceived increased risk profile of these loans) or actors being less willing to contribute to the IMF project. In this event, economies may be forced to turn to other alternatives, such as the Belt and Road Initiative, or the Asian Development Bank. While these may be ideal for some economies, the ones currently exhibiting a revealed preference for IMF loans under the status quo would be disadvantaged.

Overall, IMF loans and conditions are neither inherently constructive nor destructive, but depend on the specifics of the situation facing embattled economies. As much as IMF conditionality has been decried, it has represented a significant part of their modus operandi since the 1980s, and is unlikely to be abolished. Therefore the question moving forward becomes what conditions are applied, and to what degree. The answer will determine the IMF’s place in the global economy into the future, and the fates of countless economies.

References

Abbott, P., Andersen, T. B., & Tarp, F. (2010). IMF and economic reform in developing countries. The Quarterly Review of Economics and Finance, 50(1), 17–26.

https://doi.org/10.1016/j.qref.2009.10.005

Ban, C., & Gallagher, K. (2014). Recalibrating Policy Orthodoxy: The IMF Since the Great Recession. Governance, 28(2), 131–146. https://doi.org/10.1111/gove.12103

Dreher, A. (2009). IMF Conditionality: Theory and Evidence. Public Choice, 141(1/2), 233–267. https://www.jstor.org/stable/40270954

Dreher, A., Sturm, J.-E., & Vreeland, J. R. (2015). Politics and IMF Conditionality. The Journal of Conflict Resolution, 59(1), 120–148. https://www.jstor.org/stable/24546221

Easton, S. T., & Rockerbie, D. W. (1999). Does IMF Conditionality Benefit Lenders? Weltwirtschaftliches Archiv, 135(2), 347–357. https://www.jstor.org/stable/40440717 International Monetary Fund. (2023).

IMF Conditionality. IMF. https://www.imf.org/en/About/Factsheets/Sheets/2023/IMF-Conditionality

Masters, J., Chatzky, A., & Siripurapu, A. (2021, September . The IMF: The World’s Controversial Financial Firefighter. Council on Foreign Relations. https://www.cfr.org/backgrounder/imf-worlds-controversial-financial-firefighter

The Economist. (2023). The IMF faces a nightmarish identity crisis. The Economist. https://www.economist.com/finance-and-economics/2023/04/04/the-imf-faces-a-nightmarish-identity-crisis

Bello, W. (1999). The Asian financial crisis: Causes, dynamics, prospects. Journal of the Asia Pacific Economy. https://doi.org/10.1080/13547869908724669

Bliss. (2020, April 9). COVID-19 | Ecuador, COVID-19 and the IMF: how austerity exacerbated the crisis by Ana Lucía Badillo Salgado and Andrew M. Fischer. Bliss. https://issblog.nl/2020/04/09/covid-19-ecuador-covid-19-and-the-imf-how-austerity-exacerbated-the-crisis-by-ana-lucia-badillo-salgado-and-andrew-m-fischer/

Chalongphob Sussangkarn. (2011, October 29). Economic Crisis and Recovery in Thailand: The Role of the IMF. ResearchGate; unknown. https://www.researchgate.net/publication/242759210_Economic_Crisis_and_Recovery_in_Thailand_The_Role_of_the_IMF

Dornbusch, R., Goldfajn, I., Valdes, R. O., Edwards, S., & Bruno, M. (1995). Currency Crises and Collapses. Brookings Papers on Economic Activity, 1995(2), 219. https://doi.org/10.2307/2534613

Falco, A. C., Andrés Chiriboga-Tejada, Jayati Ghosh, Demba Moussa and Adrian. (2020, August 29). Austerity is killing Ecuador. The IMF must help end this disaster | Allison Corkery, Andrés Chiriboga-Tejada, Jayati Ghosh and Adrian Falco. The Guardian. https://www.theguardian.com/commentisfree/2020/aug/29/ecuador-austerity-imf-disaster

Finance and Development. (2023). Finance and Development | F&D. https://www.imf.org/external/pubs/ft/fandd/1998/06/imfstaff.htm#:~:text=In%20the%20latter%20part%20of,packages%20totaling%20almost%20%24100%20billion.

International Monetary Fund. (2018). 2018 Review of Program Design and Conditionality. IMF. https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/05/20/2018-Review-of-Program-Design-and-Conditionality-46910

International Monetary Fund. (2019, March 11). IMF Executive Board Approves US$4.2 Billion Extended Fund Facility for Ecuador. IMF. https://www.imf.org/en/News/Articles/2019/03/11/ecuador-pr1972-imf-executive-board-approves-eff-for-ecuador#:~:text=IMF%20Executive%20Board%20Approves%20US%244.2%20Billion%20Extended%20Fund%20Facility%20for%20Ecuador

International Monetary Fund. (2020, September 30). IMF Executive Board Approves 27-month US$6.5 billion Extended Fund Facility for Ecuador. IMF. https://www.imf.org/en/News/Articles/2020/10/01/pr20302-ecuador-imf-executive-board-approves-27-month-extended-fund-facility

Koo, J. (2006). The 1997-98 Korean Financial Crisis: Causes, Policy Response, and Lessons Presentation by Kim Kihwan ♣ at The High-Level Seminar on Crisis Prevention in Emerging Markets Organized by The International Monetary Fund and The Government of Singapore Singapore. https://hozir.org/pars_docs/refs/162/161380/161380.pdf

Reinsberg, B., Stubbs, T., & Kentikelenis, A. (2021). Compliance, defiance, and the dependency trap: International Monetary Fund program interruptions and their impact on capital markets. Regulation & Governance, 16(4). https://doi.org/10.1111/rego.12422

Thomson, M., Kentikelenis, A., & Stubbs, T. (2017). Structural adjustment programmes adversely affect vulnerable populations: a systematic-narrative review of their effect on child and maternal health. Public Health Reviews, 38(1). https://doi.org/10.1186/s40985-017-0059-2

Weisbrot, M. (2019, August 27). The IMF Is Hurting Countries It Claims to Help. The Guardian; The Guardian. https://www.theguardian.com/commentisfree/2019/aug/27/imf-economics-inequality-trump-ecuador

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.