Aid has a colossal effect on the development of Less Economically Developed Countries (LEDCs). Totalling US$194.1bn in 2020, reducing poverty levels, developing international relations, and increasing life expectancy are all benefits of foreign aid (The World Bank, n.d.). However, foreign aid can also lead to inflation, increased dependency, economic and political pressure, inefficiencies and misaligned expenditures – the list goes on.

The Development Assistance Committee (DAC) is a forum to discuss issues surrounding aid, development, and poverty reduction in developing countries; currently it has 30 members. Set up in the 1960s, by the OECD’s predecessor, the Organisation for European Economic Co-operation, the DAC quickly found that some nations were paying considerably more – proportionally – than others, and as such recognised the United Nations International Aid Target of 1964 (FÜHRER, 1996). In 1969, a 0.70% level of Official Development Assistance (ODA)/Gross National Product (GNP) was to be met ‘by 1975 and in no case later than 1980’ (OECD, n.d.). Members accepted and adopted the target (other than Switzerland, who was not a UN member at the time, and the US, who had a way with the rule book). GNP has since been replaced with Gross National Income (GNI) as an international metric in the System of National Accounts; by proxy, we now use ODA/GNI as the ratio.

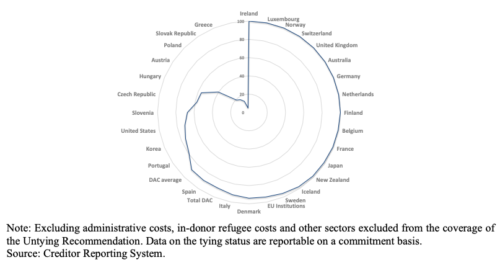

In 2005, the European Union agreed to meet the proposed target by 2015. In 2021, the European Union’s ODA/GNI ratio sat at a mere 0.49% (European Commission, 2022). The European Union’s ratio actually fell 8.1% in real terms between 2021 and 2022. Only 5 of the 30 economies actually met or exceeded the target in 2021 – those being Luxembourg (0.99%), Norway (0.93%), Sweden (0.92%), Germany (0.74%), and Denmark (0.70%). In comparison, the UK sat 9th with 0.50%; Australia 21st with 0.22%; and the US, despite donating the most in dollar terms, was joint 5th last with just 0.18% of their GNI being Official Development Assistance. The average country effort was 0.39%, nearly half the official target (OECD, 2022).

Tied aid, according to OECD (n.d.), is where a country offers aid ‘on the condition that it be used to procure goods or services from the provider of the aid’. The OECD is on a mission to untie all aid in a bid to eradicate direct costs by 15 – 30% and remove the immeasurable indirect costs.

In a paper commissioned by the OECD (and USAID), Cartinus J. Jempa (1991) found that ‘the goods and services offered [under tied aid] are of low priority to the recipient, excessively capital-intensive, highly dependent on Western technologies, and import-oriented’; suggesting that they are inefficient, and waste potential to maximise impact for recipients. Numerous papers have found that this is a persisting issue still seen today.

However, we have seen a shift away from official tied aid in the past few decades which is a promising move in the right direction (OECD, 2021). It is a move that generates a “double dividend” – a benefit in the form of a project as well as powering the local economy (i.e., with the use of local contractors, etc.). It also provides recipient countries with more autonomy, discretion over spending, improved agricultural practices and machinery, access to tap into natural resources and enhanced sanitation – all in a way that the local economy can provide maintenance and sustain long-term use. Although, the question remains of how much of this shift in aid expenditure is conscious and done actively, or whether we are seeing a change in reflection of less countries being eligible to tied aid under the Helsinki Disciplines of 1991 – whereby ‘GNI cannot be greater than the World Bank’s upper limit for lower middle-income countries, …participants cannot provide tied aid that has a occasionality level of less than 35% for eligible countries, or 50% if the beneficiary country is a Least Developed Country (LDC), and tied aid is not allowed for commercially viable projects for non-LDC eligible countries’ (OECD, n.d.)

In 2008, the Canadian government announced that it would completely untie all of Canada’s aid by 2012 in a bid to have a $200m increase in effective spending per year before increases to the ODA budget were introduced (Engineers without Borders, n.d.). As a result, Canada’s untied aid as a proportion of total aid rose from 63% to 99% (OECD, 2012). Yet, as of 2017, whilst Canada reported 100% of its aid as being ‘untied,’ 95% of contract spending by value went to Canadian firms – suggesting that it is highly likely their aid is unofficially still tied (OECD, 2017).

The rigours of political pressures are a dominant driving factor behind tied aid in many cases throughout history. Though there is no proven consensus between a donor providing tied aid and their subsequent motives of governance or influence in the recipient nation, there certainly exists a correlation, particularly in some contexts. Studies by scholars have proved that statistically, there is a robust relationship spanning high foreign aid levels and deterioration of national governance. This could be because aid inflows, particularly tied, potentially weakens governance because beneficiary governments either ceased taxation or in extreme cases, are influenced by the donor governors who undeniably now exert some willpower and political interest in the recipient nation’s governance (OECD,1991).

From a political perspective, there are many motives donors harbour when tying aid, ranging from historical ties, affinity of cultural standpoints and also the aim of nurturing and improving geopolitical relations. In this respect, aid tying is viewed as a form of protectionism for the donor, and there are many various cost raising distortions incurred to the recipient as part of this donation. Though costs do depend on flexibility of substitution (i.e. how many sources of aid are readily available to recipient nations), costs include, and are not limited to: donor induced preference of projects requiring major imports which are likely in the export interests of the donor, as well as the fact that the donor is highly likely to be predisposed to their own needs in development policy dialogues with the recipient nation (OECD, n.d.). Thus, goods provided are likely to be ones of low value to the recipient, excessively capital intensive and mainly focused on the import and influence interests of the donor. This depicts why the politics framing most tied aid, ranging from the 20th century to present day, is shadowed by uncertain and potentially dangerous reasoning.

There have been proliferated calls for aid ever since the post war eras, stemming from the Marshall Plan, which largely served as the political and economic foundation for the Western alliance which waged the Cold War against the opposing coalition. In theory and in retrospect, the Marshall Plan was the epitome and springboard for a morally political donorship embodying worldwide notions of peace and prosperity. The main goal of the Marshall Plan was to assist in the transition of many new states in the former colonies to full membership as new international membership. After initially subscribing dollars, Washington then backed up this historic alliance with military power, which backed up the political stability that had ensued from this alliance, as the West gradually began to see Western Europe not as beneficiaries but as partners (Kunz, 1997). However, some scholars argue that a key consequence and American motive of the Marshall Plan was that it made the world safe for capitalism, subtly underlined by political interest in excavating and reaping the benefits from the up-and-coming economies of the ravaged continent. Because the truth was, the majority of the funds of the Marshall Plan proved paltry in the face of the crippling bankruptcy into which post-war Europe, also in the grips of a harsh winter, had plummeted (Hattori, 2003). Yet, American policy makers refused to acknowledge this and thus, refused to examine what truly underlined their economic diplomacy, a need to seize upon the floundering state of affairs in the European nations for influence and gain – inserting itself into the political foundry, Washington managed to stabilise its own status as a beneficent superpower, a political entity to which a reeling mainland continent could turn to.

Another facet of post World War and Cold War aid schemes, which paved the way for much of current tied aid programmes and manoeuvres, were those enacted by the Soviet Union. The Soviet Union used foreign aid as a tool in order to achieve strategic objectives in the Third World, stemming from the Krushchev theories which situated aid as a method of developing what the Soviets perceived as Third World countries and also thus slowly and peacefully beginning these recipient nation’s transition into socialism (Guan-Fu, 1983). For example, the Soviets believed that by granting aid to India, the Union could foster state-owned industry as well as convince the recipient nation to gradually switch to the socialist pathway. Starting from declaring their motives at the 15th United Nations meeting in 1960, the Soviets put stress on nations they perceived as attractive to meeting their eventual strategic goals such as Egypt, India, Ghana and Mali, to name a few. The Soviets knew they could not match the Western alliances when it came to providing military aid, so they mostly focused on large scale industrial projects, knowing that through interfering in these internal affairs, they could then stand to get political influence in the nation and launch their own strategies into the recipient nation (Guan-Fu, 1983). This depicts what was discussed above, that tied aid deliberately restricts the recipient nation into submitting to the strategies of the donor nation, weakening the positive effects of the aid and extending the durability of dictatorships.

A present day example of political manoeuvring in the tied aid stratosphere is the aid-giving giant China, particularly in her recent handouts to Trinidad and Tobago. The choice of Trinidad and Tobago is strategic as it is one of the largest economies in the Caribbean, and Beijing’s main presence here consolidates in the form of large loan assisted infrastructure projects similar to what China has provided in other countries, ranging from Africa to Sri Lanka (Tudoroiu & Ramlogan, 2022). The tied aid aspect here is critical as all workers, contractors and materials used on these projects must come from China, which renders a great negative impact on the Trinidadian economy. The main purpose of Beijing’s insertion on this southern economy is of strategy, since it has always been political elites that are the main target of Beijing’s aid. Therefore, in addition to the economic losses incurred since everything related to the aid given comes from China, there is also an undermining of local institutional capacity and a sense of loss of ownership (Tudoroiu & Ramlogan, 2022). Furthermore, mirroring their domestic policies, Chinese policymakers perceive important roles for the state in helping an economy to develop and completely exclude NGOs from their foreign aid activities; they are solely focused on the strategic viewpoints and thus gaining political influence.

As established prior, tied aid can come in many different forms and with a wide range of different motives. From the exertion of political pressure, to building up future trade opportunities with the donor nation, we’ve examined some of the driving factors behind why countries spend billions on foreign aid. However, at its core, isn’t the point of aid to truly help struggling nations deal with their issues in the best way?

This is where untied aid enters the picture. According to the OECD, “tied aid is said to increase the costs of a project by as much as 15% to 30%” whilst untied aid looks to remove some of the legal and regulatory barriers underpinning tied aid and minimise these costs to maximise value for the recipient nation (OECD, n.d.). Tied aid, by requiring that all aid spending must be used on private firms from the donor nation, essentially cements themselves a monopoly, uncontested by any other foreign competition and discouraging local production. Oxfam describes this as the “tied aid round trip”, where a significant portion of aid spending is spent purely on logistical needs to facilitate buying goods from the donor country including shipping and ‘expert consultants’ (Oxfam, n.d.). It also states how a whopping 65% of US food aid budget is spent on transportation, which could be significantly cut down if the food was sourced closer to the recipient nation. This has the potential to be highly detrimental and even predatory in the long run, giving major OECD nations a significant advantage in the global economy.

A study of 152 developing countries from 1973 to 2013 found that tied aid “decelerated development” and an increase in tied aid from US$5 to US$10 per capita decelerated GDP growth per annum by 0.89% (Ganga and Girod, 2019). More damningly, the study found examples of tied food aid to India, Indonesia, Sri Lanka, Pakistan and others in the 1970s created “institutional disincentives to the expansion of food production” primarily due to a lack of incentive to invest funds in these industries when they are forced to spend aid money purely on ready–made goods from the donor nations. One can understand how this kind of incentive can handicap the potential of a developing nation in the long run.

So, what’s the alternative?

Many argue that untied aid, with a priority of helping recipient nations become more self-sufficient, is a far better allocation of funds. A great example is Afghanistan, where The Guardian reports how, from 2001 to 2011, only 37% of the US$36 billion in aid entered the local economy, which led to the creation of the “Afghan First” policy decreeing that aid procurement hound use local labour and goods to rebuild Afghanistan wherever possible (Gilmore, 2011). The policy is underpinned by the economic concept of the multiplier effect, where the effect of an initial injection of capital is amplified in its total impact on the economy (Ganti, 2022). Allowing aid grants to be spent domestically has the benefit of creating jobs to work on these contracts, which further generates profits and taxes that can be used to fund other projects, as well as significantly improving the wellbeing of those who find employment in these projects. It was found that donor contracts in Afghanistan led to businesses expanding their employee base by over 300%, with one month of employment created for every $600 spent (Gilmore, 2011). Acknowledging the ways that tied aid operates and how it differs from untied aid, there are several key advantages and disadvantages for policymakers to consider in deciding which to use in different circumstances. Generally, it can be argued that tied aid plans tend to benefit the donor country but can be a safeguard against corruption, whilst untied aid has the potential for more sustainable and long-term benefits as well as reducing the cost of providing aid.

It remains clear that untied aid prevails tied aid as the best option in giving foreign aid to beneficiary nations as it allows for a no-strings attached approach to the development of recipient countries. In order to forge a path towards a more equitable world, donor countries must realise the value that untied aid provides to its beneficiaries without the political and economic interference of outside influences. The gift of foreign aid must only be given in hopes of lifting developing countries out of poverty and allowing them to create sustainable and necessary infrastructure whilst expanding local economies and workforces.

Engineers without Borders. (n.d.). Untie Aid. Retrieved from Engineers without borders: https://www.ewb.ca/en/what-we-do/advocating-for-change/campaigns/untie-aid/

de Haan, Arjan & Warmerdam, (2014) ‘The Politics of Aid Revisited: A Review of Evidence on State Capacity and Elite Commitment’, (Oxford, 2014; online edn, Oxford Academic, 22 Jan. 2015), https://doi.org/10.1093/acprof:oso/9780198722564.003.0010

European Commission. (2022, June 18). Team Europe’s Official Development Assistance reaches €70.2 billion in 2021. Retrieved from European Commission: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_4532

FÜHRER, H. (1996). THE STORY OF OFFICIAL DEVELOPMENT ASSISTANCE. Paris: Organisation for Economic Co-operation and Development.

Ganga, P.D., & Girod, D.M. (2019). Ties That Bind: The Impact of Tied Aid on Development.

Ganti, A. (2022). What Is the Multiplier Effect? Formula and Example. Investopedia. Retrieved 28 September 2022, from https://www.investopedia.com/terms/m/multipliereffect.asp.

Gilmore, S. (2011). Afghanistan: proof that untied aid really works. Retrieved 28 September 2022, from https://www.theguardian.com/global-development/poverty-matters/2011/oct/24/afghanistan-untied-aid-creates-jobs.

Gu Guan-Fu (1983) Soviet aid to the third world, an analysis of its strategy, Soviet Studies, 35:1, 71-89, DOI: 10.1080/09668

Hattori, T. (2003). The moral politics of foreign aid. Review of International Studies, 29(2), 229-247. doi:10.1017/S0260210503002298

Jempa, C. J. (1991). The Tying of Aid. Paris: OECD.

Kunz, D. B. (1997). The Marshall Plan Reconsidered: A Complex of Motives. Foreign Affairs, 76(3), 162–170. https://doi.org/10.2307/20048105

OECD. (2012). Profiles and policies of bilateral donors: Canada. Paris: OECD.

OECD. (2017). 2017 REPORT ON THE DAC UNTYING RECOMMENDATION. Paris.

OECD. (2021). Development Co-operation Report 2021. Paris.

OECD. (2022). ODA Levels in 2021- Preliminary data. Paris.

OECD. (n.d.). Aid and Export Credits. Retrieved from OECD: Better Policies for Better Lives: https://www.oecd.org/trade/topics/export-credits/aid-and-export-credits/

OECD (1991) The Tying of Aid: Development Centre Studies https://www.oecd.org/development/pgd/29412505.pdf

OECD. (n.d.). The 0.7% ODA/GNI target – a history. Retrieved September 2022, from OECD: Better Policies for Better Lives: https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/the07odagnitarget-ahistory.htm

OECD. (n.d.). Untied Aid. Retrieved September 2022, from OECD: Better Policies for Better Lives: https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/untied-aid.htm

Oxfam. The tied aid “round trip” [Ebook]. Retrieved 28 September 2022, from https://s3.amazonaws.com/oxfam-us/static/oa3/files/aidnow-tiedaidroundtrip.pdf.

The World Bank. (n.d.). Net official development assistance and official aid received (current US$). Retrieved September 2022, from The World Bank Data: https://data.worldbank.org/indicator/DT.ODA.ALLD.CD

Tudoroiu, T., Ramlogan, A.R. (2022). China’s Tied Aid to Trinidad and Tobago: Impact and Perceptions. In: Tudoroiu, T., Kuteleva, A. (eds) China in the Global South. Springer, Singapore. https://doi.org/10.1007/978-981-19-1344-0_8138308411459

Untied Aid – OECD. Oecd.org. Retrieved 28 September 2022, from https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/untied-aid.htm.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.